About Bitcoins Instant#q=i Bought Bitcoins With Corned Beef Instantly and They're Not Showing Up

Is Bitcoin a new kind of currency? Is it a new kind of computer network? Is it software, an economic arrangement, a way to send money across the earth?

The short answer is yeah! Bitcoin is a lot of things, and the technology is condign more powerful as each week goes past. That's because Bitcoin provides a massive, global platform that is open and free for anyone to build on and develop.

At its core, Bitcoin allows people to use the internet to engage in transactions that can be validated and confirmed without the need for an intermediary, which enables safe peer-to-peer transactions at an unprecedented scale.

The promise of Bitcoin is that it can become a global platform that is not in the control of whatever company, government, or special interest (other than the developers and miners of the Bitcoin customs) and make independently sharing critical information (such as transaction details) safe, scalable, efficient, and cost-effective.

Birth of Bitcoin

Bitcoin is the beginning massively adopted cryptocurrency. The concept of Bitcoin was first outlined in late 2008 past a person or group operating under the proper noun Satoshi Nakamoto.

Before Bitcoin, there was a movement to create a kind of money or currency that was native to the net — a course of digital greenbacks. The reasons for creating some kind of digital method of transferring value was seen as a significant milestone in truly building out an open and universal platform for sharing and transferring information.

Caption: This is an image of the Bitcoin Whitepaper, which was written by the mysterious Satoshi Nakamoto and has get the ground for what nosotros now know equally the cryptocurrency motility. The paper laid out the design of Bitcoin and explained how it can be used as a peer-to-peer payment network. In the years since the paper's publication, people all over the world accept been building on top of the open-source engineering and contributing to improve the underlying reckoner code with the goal of making the network more robust.

Some of the forebears to Bitcoin (like Hashcash and DigiCash) made progress on the idea of internet-based money, but they were limited in their application because they still relied on an intermediary.

Whatsoever fourth dimension there is an intermediary involved with a digital transaction, there is a cardinal bespeak of failure — or a security threat. But before Bitcoin, intermediaries were required because in that location was no other way to trust the legitimacy of the digital transactions. Without intermediaries, things like fraud and theft would run wild without recourse. But the employ of intermediaries also comes at a cost of fourth dimension and coin.

And that'southward where Bitcoin comes in. When Nakamoto start created Bitcoin, it was under the idea the net needed a peer-to-peer system to transfer value (much like the way cash works in the analog world). If a digital peer-to-peer arrangement existed, it would complimentary people to interact with unprecedented efficiency and at an unprecedented calibration.

Looking for more info near the history of Bitcoin and some of the issues it was designed to solve? Check out Abra's illustrated explainer guide about Bitcoin's past, present, and future: Code meets money: The lucifer that made bitcoin.

Looking for more info near the history of Bitcoin and some of the issues it was designed to solve? Check out Abra's illustrated explainer guide about Bitcoin's past, present, and future: Code meets money: The lucifer that made bitcoin.

In club to solve for required intermediaries to enable digital transactions, Satoshi Nakamoto developed Bitcoin to solve the problem known in informatics as double spend. Before, bitcoin, the double-spend problem , or the ability to rapidly and easily verify the legitimacy of a transaction without layers of complicated and costly infrastructure was a vexing problem.

Reflections on the Bitcoin Whitepaper as information technology turned 10.

This meant, in the context of money, that information technology was hard to accept any level of trust in transactions, or that transactions were non fraudulent.

But the invention of Bitcoin changed all of that by creating a distributed, public ledger which confirmed transactions (through incentivized ciphering known equally mining, discussed in greater depth below). This auditable, distributed ledger that is the backbone of Bitcoin ( other cryptocurrencies too rely on this applied science) is called a blockchain.

By using a system of exchanges, wallets, and bitcoin addresses, anyone in the world is now able to exchange value dorsum and along across the cyberspace without the need to put any kind of trust in an intermediary similar a bank, credit card company, or payment processor.

Bitcoin provided a blueprint, not only for an entirely new cryptocurrency industry (in the terminal ten years more than 2,000 cryptocurrencies have been adult), just it also opens the door to other kinds of financial innovation and access — such every bit new forms of credit and lending, as well as crypto-collateralized investing .

At Abra, we believe in the power of Bitcoin and crypto more broadly, and we are working to build a unmarried, piece of cake-to-use app that will provide global access to of import fiscal services such every bit investing, coin transfer, and more on the way.

A quick notation about Bitcoin versus bitcoin: You may notice while reading this page, or on other pages on this site that both Bitcoin with a capital B and bitcoin with a lowercase b are used. This is intentional. We refer to the names of underlying software or networks as proper nouns, and so Bitcoin. When nosotros are talking about the bodily currency, we employ lowercase b, and then bitcoin. Where it gets disruptive is those times when we are talking about both the currency and the network, in which case nosotros apply Bitcoin. This is a style conclusion and in other places across the internet you might see Bitcoin only referred to with the capital B or the lowercase b.

Bitcoin as digital money

Bitcoin is a cryptocurrency, and its symbol or abridgement is BTC on places similar CoinMarketCap, which track the prices of cryptocurrencies.

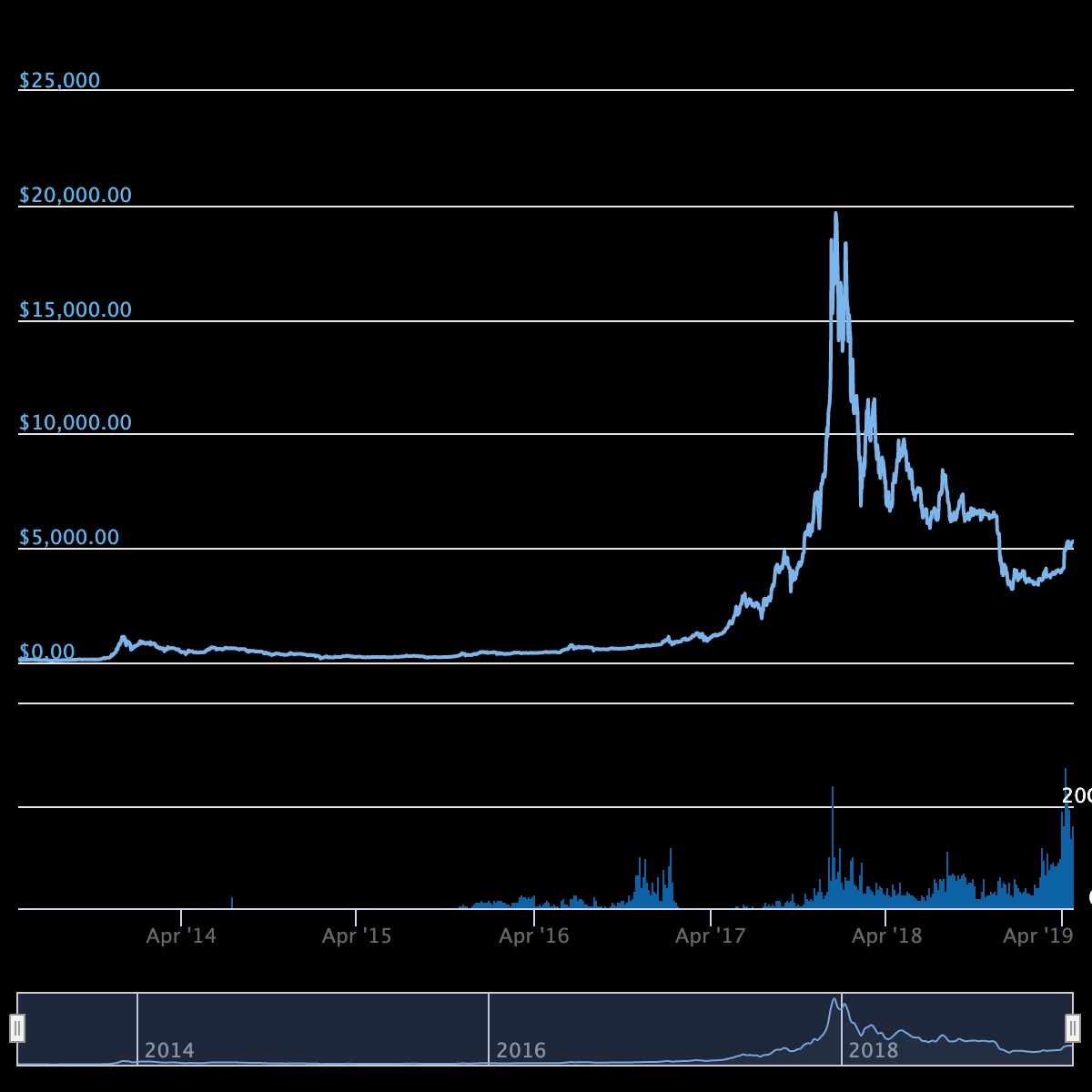

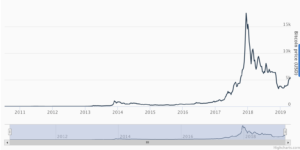

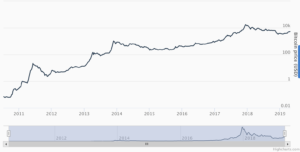

This nautical chart shows the growth of the bitcoin price from 2013 through April 2019. Bitcoin was beginning launched in early 2009, merely some of the primeval chart data available starts in 2013.

Just like people use dollars to accomplish different goals, bitcoin can also be used as a currency in a few different contexts. Bitcoin can exist used to pay for things (but like if you were paying with dollars or pesos when using an app like Apple Pay), an investment (speculating that the future value of the network will be greater than it is today), a store of value, and to send or receive money (especially powerful if sending coin beyond international borders, which using today'southward traditional systems requires a lot of friction).

1 important aspect of bitcoin that is often misunderstood by people showtime getting into cryptocurrencies, is that information technology is possible to buy, sell, send, and receive a fraction of a bitcoin. And so if the price of bitcoin is $20,000, but a bitcoin buyer merely has $10 that they want to transport or invest, then that user can buy $10 of bitcoin. Bitcoin can be divided down to eight decimal places, and those tiny fractions of bitcoin are known by some as satoshis (i satoshi = 0.00000001 BTC). Since bitcoin exists equally estimator lawmaking it is easily divisible.

Because it is a digital currency, bitcoin is pretty much like e-mail for money. The same manner anyone tin create an email accost to ship and receive letters, anyone tin can create a bitcoin wallet to hold, send, and receive money with but a smartphone and a data or internet connection.

Where financial systems were previously clunky, slow, and expensive to apply, bitcoin provides a common linguistic communication that computers tin can use to transfer coin or value speedily and securely, and at a potentially much lower cost considering information technology is a system with no intermediaries or banks.

Another thing that makes bitcoin great digital money is that it is programmable. That ways that the Bitcoin protocol can be used to write and execute smart contracts, which enable more efficient (and cost-effective) ways of conducting business.

Lookout man Abra founder and CEO explain how Abra has created engineering science to leverage the programmable features of Bitcoin to created new financial infrastructure.

The evolution of smart contracts volition open a new frontier of financial engineering that have so far been incommunicable in traditional finance. Since the invention of Bitcoin and the thought of multi-signature smart contracts, other cryptocurrencies have launched that are developing other kinds of smart contract functionality, and to serve as smart contract platforms. Ethereum is one example of a popular (it is the second cryptocurrency by market place capitalization ) that is attracting a lot of developer attention. Other examples of emerging smart contract platforms include Cardano , EOS , and NEO .

What can I do with Bitcoin?

When Bitcoin was first invented, its creator Satoshi Nakamoto envisioned one purpose for the engineering : electronic payments. Since then, people take figured out how to employ bitcoin's engineering for a variety of uses.

Picket Abra founder and CEO give one of the first TED Talks about Bitcoin. The talk took place in 2012 when ane bitcoin was worth about $5.

Bitcoin is ofttimes called a protocol, which means it is like a foundational layer that other services, technologies, companies, etc. can use to build. Just like the internet uses TC/IP as an underlying protocol that makes just about everything else on the internet possible.

Abra is a perfect instance of a visitor built using the underlying functionality of Bitcoin to build something new.

Other companies, people, and projects are edifice all kinds of new fiscal and information infrastructure on top of Bitcoin. Everything from faster, seamless micropayments to complex derivatives trading are currently operational using Bitcoin's blockchain as basic infrastructure.

People are also developing Bitcoin for other applications besides finance. Documenting and monitoring supply chains is one popular thought. Other ideas for using Bitcoin-inspired engineering science include systems for better medical and property tape keeping to edifice things like carbon markets.

Here are some ways that you can employ bitcoin today:

Transport/RECEIVE Money

Every bit a purely digital currency, bitcoin is borderless. Considering information technology'southward available nearly everywhere, you can ship money around the world simply as easily as you send information technology across the room.

Really all people need to exist able to send and receive coin internationally is a smartphone and each party to the transaction needs to have a bitcoin wallet. Sending money is nearly instantaneous — it can accept betwixt 10 minutes or up to a couple of hours for the transaction to exist processed on the Bitcoin blockchain and then available on the other side of the transactions. Fifty-fifty with a slight lag, this is all the same style faster than trying to do a complex international bank transfer or for using an international wire service such as Western Union.

INVESTMENTS

Similar to buying gilt or stocks, some people similar to buy bitcoin as an investment in hopes that its value will go up. Historically, the price of bitcoin has been very volatile but overall, every bit mining has become more difficult and buying has become easier and more pop, the price has gone up over fourth dimension.

Watch Abra CTO Willie Wang talk well-nigh how cryptocurrencies like Bitcoin tin can be used to build the cyberbanking of the future.

At that place are a few dissimilar investment ideas surrounding the Bitcoin network and the bitcoin currency. Here are a couple of loftier-level ideas about why people around the world are excited near investing in Bitcoin. It should be noted that there are a lot of reasons people view bitcoin and other cryptocurrencies every bit potential investments.

Three ideas for investing in Bitcoin:

- Reserve currency: A reserve currency is used to settle international trade and is viewed every bit strong and stable. Correct now the dollar is the world's most dominant reserve currency, followed past the euro. At other times in history, other national currencies — and for a long fourth dimension aureate — have been used to settle international debts, hold every bit a long term store of value, and are used to denominate values for merchandise.

Some bitcoin investors call back that because of bitcoin's digital, open, decentralized, and apolitical nature, it has the necessary attributes to go a global reserve currency. Over fourth dimension, every bit adoption and liquidity increase, bitcoin could get less volatile.

- Digital gold: Another potential upshot for bitcoin is its use as a course of digital gold or a digital store of value. Equally more than and more than of everyday life unfolds on the internet, it's only natural that people will beginning wanting to store value on a digital platform. This allows for easy access, greater liquidity, and the ability to take the value literally anywhere beyond both the physical and virtual worlds.

Having a single source of digital wealth as an idea is growing in popularity, and even despite its volatility on a month-to-calendar month basis, bitcoin has shown that it is a expert store of value over its lifetime.

- Protocol adoption: Bitcoin investors are likewise bullish on the idea is that the Bitcoin network or protocol will merely keep to evolve, mature, and grow. As it does, and as more companies, projects, and people start using the network and building on the protocol, then it will continue to grow in value. A very basic comparison is often made between the growth of the internet and the potential for the Bitcoin protocol to grow.

- Apply as collateral: Another emerging idea in terms of investing in bitcoin is that information technology can exist used as a style to digitally collateralize other non-digital avails, such equally real estate or traditional stocks and commodities. The advantages to doing this are that Bitcoin provides a manner to easily document and verify buying and chain of custody, while at the same time bitcoin-based contracts are easily traded and they are universally bachelor.

Finally, bitcoin collateralization allows users to fractionalize investments (or make more than divisible pieces — so that a large building or a prohibitively expensive share of the stock market can exist made into smaller portions). The whole concept of bitcoin as collateral is a great example of fully leveraging the programmable features of cryptocurrencies to create products and services that take non yet existed in finance and beyond.

These are simply a few examples of some of bitcoin's investment potential. There are many other potential uses, ranging from machine-to-machine payments, micropayments, and conditional debits and credits spread amongst a big grouping of people or entities.

COMMERCE

Bitcoin was originally developed every bit a peer-to-peer payment method or a form of digital greenbacks. In the spirit of bitcoin as digital cash, over 100,000 online merchants have bitcoin payments.

An increasing number of local businesses also have bitcoin. Use coinmap.org to find a business in your area.

One strong apply case for using bitcoin for commerce is that it is really easy to send long distances and because of the public/individual primal setup, people on both ends of the transaction are able to deport concern without really needing to know much nigh the other'southward identity and without the need for a centralized third party.

Bitcoin ATMs and other easy on- and off- ramps are becoming more widespread so that it will be easier for people to speedily move back and forth between traditional fiat systems and emerging cryptocurrency systems.

DONATIONS

In addition to the many online merchants who have bitcoin for e-commerce payments, at that place are also many nonprofits and interesting cyberspace-based projects that accept bitcoin donations.

At that place is also a growing movement of Bitcoin-based philanthropy, and organizations such as the California-based BitGive Foundation are using the Bitcoin blockchain to runway gifts fabricated past donors to build international projects, such equally clean water and sanitary infrastructure.

TIPPING

Tipping is a way to send (usually) small amounts of money as appreciation for someone else'due south piece of work. Some online content creators, for example, will leave their bitcoin address or QR code at the stop of their manufactures and tin ship bitcoin directly to their wallet.

The introduction of the Lightning Network fabricated using bitcoin for microtransactions such as tipping feasible technically and cost-effective from a network perspective. Ane reason why engineering like Lightning Network is and so constructive is that information technology is what's known as a layer 2 solution.

Layer ii solutions are new projects and technologies that are being built "off-chain" but that are designed to easily interoperate with the Bitcoin blockchain. Layer two solutions are thought of equally i mode to speedily and cheaply scale Bitcoin's capabilities without having to overhaul Bitcoin'due south chief protocol layer.

The project tippin.me is ane example of a bitcoin wallet interface developed to use the Lightning Network to create a simple and piece of cake-to-use bitcoin tipping interface.

Involvement Begetting

Some other recent tendency in the Bitcoin space is that wallets and exchanges accept started to pay interest to users when they hold their cryptocurrency investments on the platform. The crypto can and so be used past the platform to make other investments or perform other transactions, much in the way that banks use the funds stored past their account holders in exchange for paying interest.

Additionally, crypto networks themselves might begin paying involvement in the future every bit the network models movement from proof-of-piece of work to proof-of-stake or some other kind of consensus model.

In other words, instead of paying miners to verify transactions and create and ostend the blockchain, which is the proof-of-work model, proof-of-stake blockchains volition let users to stake their coins or tokens to formulate consensus about which blocks are valid.

Agreement the Bitcoin protocol

Similar email, Bitcoin is a protocol. Where e-mail is a protocol for sending messages over the cyberspace, Bitcoin is a protocol for sending money over the internet. The Bitcoin protocol defines the rules of a payment network to pay computers around the world for securing the network. The software that implements the Bitcoin protocol uses a special branch of mathematics called cryptography to ensure the security of every bitcoin transaction.

The rules of the bitcoin protocol include the requirement that a user cannot transport the aforementioned bitcoin more than once (the double spend problem discussed before) and a user cannot send bitcoin from an address for which they practise not possess the private primal. If a user tries to create a transaction that breaks the rules of the bitcoin protocol, it volition automatically be rejected by the remainder of the Bitcoin network.

Bitcoin addresses

Agreement Bitcoin addresses is an of import building block because a Bitcoin accost is central to sending and receiving bitcoin and making sure that bitcoin is secured properly.

Bitcoin uses public key cryptography in order to create a bitcoin address. Bitcoin addresses are stored in Bitcoin wallets (there are unlike kinds of wallets, and safe handling of bitcoin wallets is really of import, then more on wallet options below.

The affair to sympathize about public key cryptography is that there is a public key, which is accessible and visible to everyone — in fact you share your public fundamental with people in guild for them to send you lot funds, or someone can employ your public key to view transaction details on the public blockchain (similar confirm funds

in advance prior to engaging in a transaction). Simply in that location is likewise a private key, which only the owner of the bitcoin wallet should possess and control. Without the private fundamental, any assets stored on the Bitcoin blockchain are inaccessible.

This public/private setup

A bitcoin address looks like this:

19wrFHPLc23rqeeZx1YAb5wjNLr8oDMg7G

Bitcoin addresses are often turned into QR codes and then they can easily exist scanned by a smartphone camera:

(Notation: bitcoin sent to that accost cannot be spent, so don't try it unless y'all like throwing away money!)

Like an email accost, a bitcoin address tin can be shared with anyone that the owner wants to receive a bitcoin payment from. Private keys, on the other hand, should non exist shared. Anyone who possesses the private key to a bitcoin address tin spend the bitcoin sent to that accost.

The Bitcoin network

The Bitcoin network is made upward of thousands of computers effectually the world called "Bitcoin nodes" and "Bitcoin miners." Bitcoin is an open network, meaning anyone can run Bitcoin software to become a bitcoin node (running a node entails downloading a copy of the Bitcoin blockchain) or if they have the correct kind of equipment, they tin can become a Bitcoin miner.

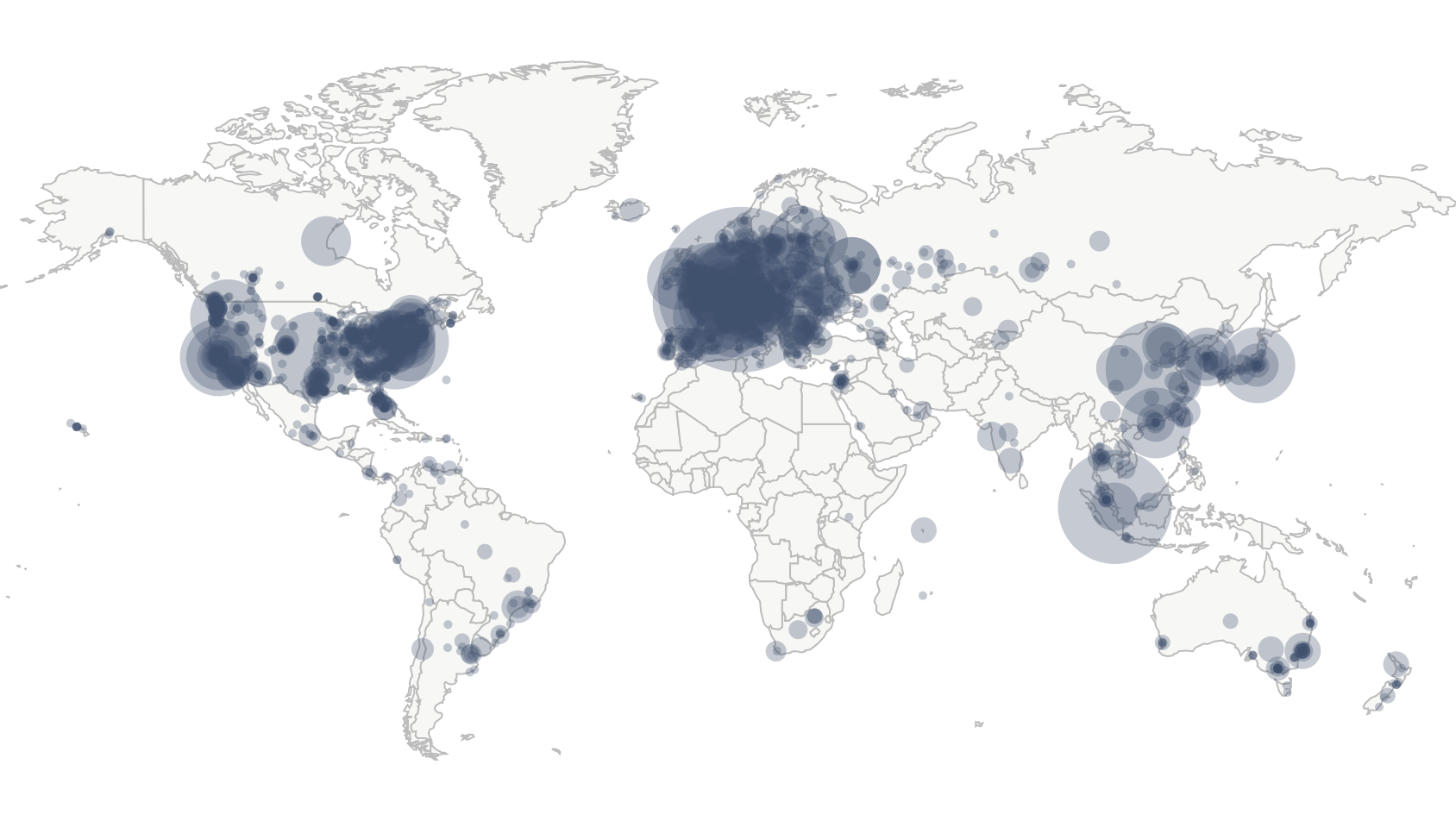

This map shows the global distribution of Bitcoin nodes around the world as of mid-2019. For a alive view of the map check out: https://bitnodes.earn.com/nodes/alive-map/

Bitcoin nodes help enforce the rules of the Bitcoin protocol while Bitcoin miners procedure transactions and add together them into "blocks" that are confirmed by bitcoin nodes. The Bitcoin protocol is designed to ensure that new blocks are created and confirmed approximately every 10 minutes.

The Bitcoin network is really unique considering it is a distributed network of people and machines working together and coming to agreements through a combination of consensus algorithms and a kind of customs governance for things like updates and protocol changes through a process known as forking . A fork, simply put, is a code update, only the customs decides if they want to follow the new version of the code, or proceed running the one-time version of the code.

About forks are not contentious and are relatively minor software updates. Non-contentious or modest forks are known as soft forks and they happen regularly. Bigger protocol overhauls, which can sometimes be contentious, are known as difficult forks. Bitcoin has gone through a number of hard forks or difficult fork proposals in the past. Some of the more than well-known forks have been around increasing the Bitcoin cake size, which would impact the price and fourth dimension to process transactions.

Ane hard fork resulted in Bitcoin Greenbacks , which was created to increase block size with the goal of making Bitcoin Cash more usable as a spendable currency. Another big hard fork in the cryptocurrency earth happened when Ethereum split from Ethereum Archetype over a governance dispute.

To secure each cake of Bitcoin transactions, Bitcoin miners must use their calculating power to solve a unique math problem provided by the Bitcoin software. If a Bitcoin miner can solve the math problem earlier any other bitcoin miner, they volition win a "block reward" that consists of all the fees paid by each transaction included in their cake, equally well as newly generated bitcoin.

Bitcoin mining

The Bitcoin network is constantly maintained (and blocks of transactions are confirmed as accurate) past specially designed computer hardware known as mining rigs.

Large-scale industrial Bitcoin mining operations look a lot like information centers. (Prototype courtesy Wikimedia Eatables)

Bitcoin miners take a strong incentive to produce blocks that follow the rules of the Bitcoin protocol. If a bitcoin miner produces a block that does not follow the rules of the Bitcoin protocol, so Bitcoin nodes will reject the cake and the miner will lose out on their risk to win the block advantage.

The sheer amount of computer power (known every bit the hash charge per unit) needed to mine bitcoin is controversial. For some, the use of electricity to run computer equipment to perform calculations to win the block advantage seems like a misallocation of resources, specially given pressing issues such as global climate change.

But the reason for the energy consumption is that it creates a cost for running and managing the Bitcoin network. The cost of running the network helps reinforce the underlying value (as bitcoin becomes more valuable, the cost of mining goes up, which makes the network more than valuable). The energy inputs in a lot of means mimic the production requirements of other extractive industries that use the investment of capital and energy to produce something that is valuable — such equally the process of mining precious metals.

The high level of energy required to perform bitcoin mining also helps keep the network secure. Ane threat to Bitcoin and other crypto networks is a 51% assail. A 51% occurs when a bad actor is able to capture more than one-half of the current mining ability and substantially dispense the underlying blockchain, potentially invalidating previous transactions or otherwise compromising the integrity of the ledger.

So proof-of-work bitcoin mining, despite the controversy, is enormously valuable.

A quick aside, but it'll be worth it: The two dominant consensus algorithms currently discussed in the cryptocurrency space are proof-of-work and proof-of-stake. A consensus algorithm is a foundational piece of how these permissionless and distributed systems work. Since there is no centralized gatekeeper or referee, there has to be an orderly standard by which the network can be confirmed and maintained.

Nearly (merely non all, the currency XRP being one exception) currently utilize proof-of-piece of work as a means of deciding which of the transactions are accurate and how blocks of transactions are arranged and documented on the blockchain, forming an immutable (or censorship-resistant) ledger.

Proof-of-stake, which Ethereum is attempting to move to, entails a system of delegated consensus, past which holders of the currency elect to put upward some of their coins every bit collateral and use that collateral to vote as a means of finding consensus (the risk is that if yous back bad actors you will lose your stake or the collateral that you put up). There are other forms of consensus that some crypto projects are trying out too.

Bitcoin price

Most conversations about Bitcoin somewhen detect their way to the price of bitcoin. And for good reason. The price movements of bitcoin, since its inception, have been historic.

The bitcoin cost is characterized by heavy volatility. That means that instead of a steady rise in price over the last decade, bitcoin'southward price has zig-zagged, reaching all-time highs several times, simply to retrace some of its steps, retreating from the highs only to rebound again.

I important thing to understand is that on a yearly basis, the price of bitcoin keeps increasing, even if the daily or weekly bitcoin price might see wild fluctuations.

One actually articulate fashion to understand the difference betwixt the short-term bitcoin price and the longer-term bitcoin price increment is to written report linear price charts and compare them to logarithmic charts.

But what does this hateful in terms of the bitcoin toll?

1 of import thing to keep in mind is that the price of bitcoin and the value of bitcoin are not always equal. Many observers believe that as the bitcoin market place matures the toll and the value will rails closer to i another and the big, dramatic swings will

The bitcoin price is oft tracked by cryptocurrency information companies such as CoinMarketCap, or Coin Gecko. Those companies collect information from numerous exchanges where people are buying and seeing cryptocurrency trading pairs.

Full marketplace capitalization, which is another of import price metric, is determined by multiplying the current price of bitcoin by the circulating supply.

On Dec 17, 2017, the bitcoin cost hit a celebrated high of $20,089 on CoinMarketCap.

How to purchase bitcoin

After learning about Bitcoin so of the advantages and potential use cases of Bitcoin, the question "How can I purchase bitcoin?" usually comes up.

The good news is that in that location are a number of ways to answer the "How can I buy bitcoin?" question, which is outlined in more depth beneath.

It'southward important to proceed in mind that bitcoin is completely digital and that in that location is no such thing as a physical bitcoin. Despite the use of words and descriptive terms similar wallet and miner, the beauty of Bitcoin is that information technology really but exists as computer code. But that lawmaking can take a value fastened to it (in the same mode that a precious commodity, similar diamonds or gold, can have a value attached to them).

Like more than traditional bolt, bitcoin'southward value comes from its programmed scarcity and from the fact that it takes energy to create and maintain, which was covered in more depth above.

Another huge thing to remember when thinking about "how I can buy bitcoin" or when getting prepare for a first-time bitcoin buy is that buying bitcoin also requires figuring out how to handle and shop the bitcoin. While there is a little scrap of a learning bend involved in making the correct decisions about where to buy bitcoin and so the correct storage methods, it is really getting easier every day to buy bitcoin and and so use it for a wide variety of applications.

And that's 1 of the greatest things about Abra. As an piece of cake-to-use global investment app, Abra users are able to buy, sell, hold, send, receive, and invest bitcoin in a number of different digital avails all from one app.

Today, Abra users can buy bitcoin right from the app using a credit/debit card, a bank or wire transfer, or they can convert other cryptoassets (similar litecoin, ether, and bitcoin cash) into bitcoin.

Beyond Abra, there is a whole ecosystem of other crypto products and services that are all getting ameliorate and easier to utilize.

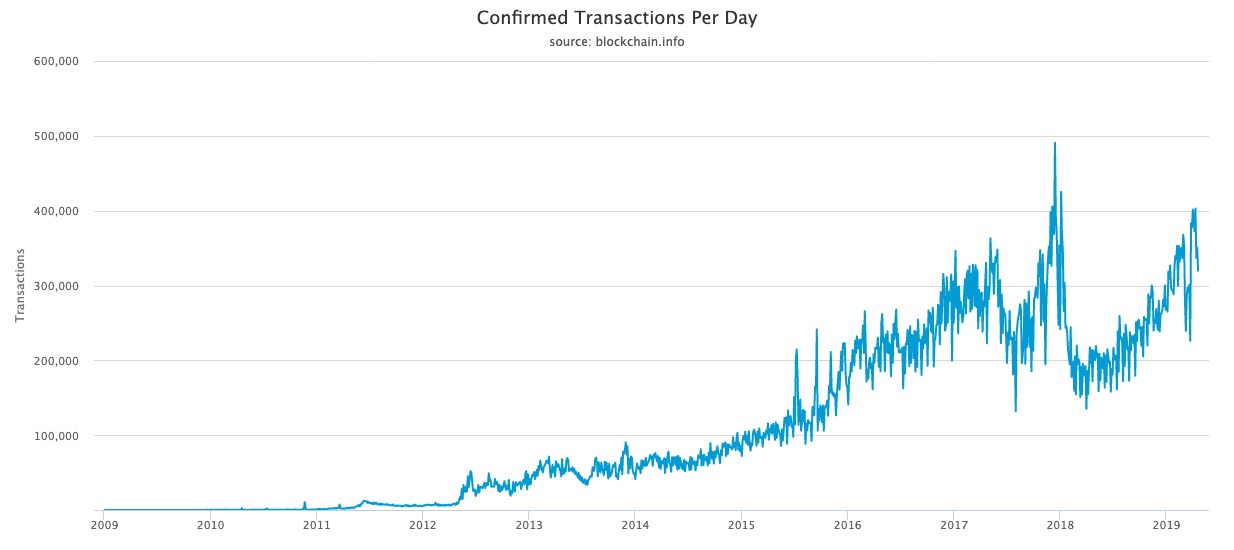

This chart shows the growth in the number of daily bitcoin transactions over time.

If you are interested in how to buy bitcoin, check out some of these options:

Where to purchase bitcoin

EXCHANGES

Bitcoin exchanges are companies that create a alive marketplace for buying and selling bitcoin. Customers will deposit bitcoin or fiat currency into their accounts then place unlike order types that are recorded on an lodge book managed by the substitution. Some exchanges offer simple limit orders, while others offer avant-garde gild types such every bit stop-loss orders and margin trading.

Having an account with a bitcoin exchange is similar having a seat on the NYSE. Bitcoin exchanges are great for twenty-four hours traders and institutional traders who trade bitcoin total time. They often require avant-garde knowledge of financial markets to use correctly.

BROKERS

Bitcoin brokers are individuals and companies that take purchase and sell orders and execute those orders on an substitution on behalf of their customers. The broker will often receive a fee for their service and the customer will receive the bitcoin they placed an order for in exchange.

If having an business relationship at a bitcoin exchange is like having a seat at the NYSE, and then doing business with a bitcoin broker is similar having an east*Merchandise or Charles Schwab account. The advantage of using a broker is simplicity. The customer asks for a quote, places an order, and receives what they asked for, and the banker removes the complexity of dealing with an exchange.

OTC MARKETS

Bitcoin over-the-counter (OTC) markets are "off-the-books" decentralized exchanges that happen through contiguous meetings and remote trades. In a face-to-face substitution, the buyer and seller will meet at a designated time and place and exchange cash for bitcoin at an agreed-upon charge per unit. In remote exchanges, the merchandise is coordinated by telephone, e-mail, or some other remote communication method. After a price is agreed upon between buyer and seller, the heir-apparent will transport an electronic funds transfer to the seller and the seller will transport the bitcoin to the buyer's bitcoin address.

OTC markets are virtually useful for either ownership bitcoin with cash or purchasing large blocks of bitcoin at a guaranteed price. These trades protect against "slippage" that can occur when purchasing large amounts of bitcoin on an substitution.

Ranging beyond a spectrum, OTC markets are used to handle everything from big trades worth millions of dollars to smaller transactions. Local Bitcoins is an example of a peer-to-peer exchange method where people can trade greenbacks for Bitcoin anywhere in the world. The Local Bitcoin site helps to lucifer bitcoin buyers and bitcoin sellers and then they can conform trades, ordinarily based on market rates.

OTC bitcoin markets have been around since the very first bitcoin trades, and they still provide a really valuable office in the bitcoin and cryptocurrency ecosystem. OTC services are particularly important in parts of the earth where access to financial infrastructure is difficult to obtain, or where there are no other options for ownership and selling bitcoin.

ABRA

Abra is a bitcoin-based digital wallet app that lives on your smartphone . It is the easiest way to buy, sell, store, ship and receive bitcoin from anywhere in the globe. It's similar to a brokerage, but it's besides a wallet. Abra supports bitcoin as well as over 50 global currencies which means you tin can convert in and out of bitcoin or any available currency, easily. Yous tin can also send bitcoin to anyone who has a bitcoin or an Abra wallet and receive bitcoin or money.

Aside from existence easy to use, fast, and flexible, ane of the advantages of Abra is that the visitor uses peer-to-peer engineering science, so your money goes directly from you to your recipient with no middleman, allowing for your transactions to be very quick and inexpensive.

Whenever an Abra user opens a new wallet a random recovery phrase is generated that acts as the private cardinal discussed earlier. The recovery phrase is a crucial office to the security and functionality of Abra'south wallet model and while Abra users need to take an added step to safeguard the recovery phrase.

Once Abra users have their secure wallet established (and they take tested their recovery phrase) they can so use the Abra app to send, receive, and shop bitcoin and other digital avails.

Abra users can also apply the app to buy bitcoin, or catechumen other assets into bitcoin with Abra and then transfer that bitcoin to any external bitcoin wallet, or they can employ the Abra app to send bitcoin to any other Abra user.

How to store bitcoin using a bitcoin wallet

Just like in that location are a few different ways of buying bitcoin, there are too a few different methods of storing bitcoin one time you have some. Bitcoin is stored in wallets, which are a fiddling flake of a misnomer considering a bitcoin wallet doesn't concord actual bitcoins, but rather information technology holds the keys needed to access bitcoin on the blockchain.

What is a bitcoin wallet?

Bitcoin wallets are software applications that implement the rules of the Bitcoin protocol to ensure that users can easily and securely transport and receive bitcoin transactions. Bitcoin wallets also evidence information most each transaction that is relevant to the wallet, including transactions sent and received by the wallet.

To receive payments, a wallet will usually generate a new address for each transaction. To send payments, the wallet volition digitally sign transactions with the correct individual keys and broadcast transactions to the bitcoin network. Once a transaction is confirmed by the network, the wallet will no longer be able to spend the same bitcoins used in the transaction once more.

When y'all think nigh buying bitcoin, you lot will likewise need to think well-nigh a place to store it. Bitcoin is usually stored in wallets. Bitcoin wallets use special codes called private keys to authorize transactions. Anyone who has the private key to a bitcoin wallet tin can authorize transfers to other wallets. Hence, it is very of import to keep the individual keys to your wallet rubber and secure.

Bitcoin wallets can be offline (too known as cold storage) or digital wallets. Additionally, they can exist custodial or non-custodial. When using a custodial wallet, yous are entrusting a third party to concur your private cardinal. When using a non-custodial wallet, y'all are the simply 1 to have the key to your wallet.

Not all crypto wallets are created equal. There are a few different types of wallets, and the all-time bitcoin wallet largely depends on how yous plan to use bitcoin, what your adventure tolerance is, and how much time and energy you want to put into securing your bitcoin.

Bitcoin wallets largely exist on a spectrum. On ane side of the bitcoin wallet spectrum, there are wallets that are like shooting fish in a barrel to use, but that require users to requite up levels of security in substitution for that ease of use.

On the other terminate of the bitcoin wallet spectrum are wallets that might take additional time or expense to set up and establish — and they might be more difficult to access on a day-to-twenty-four hours basis, but they provide secure long term storage of bitcoin and other digital assets.

The groovy matter nearly bitcoin wallets is that most bitcoin users take more than than i kind of wallet depending on how when and how ofttimes they programme to use their crypto. Another thing to consider is that bitcoin wallet design and usability is getting better every mean solar day, which means that in the future there will be fifty-fifty better and more secure options.

The most common types of bitcoin wallets

- Custodial crypto exchanges and wallets : Many crypto exchanges and/or wallets are custodial, which ways the exchange controls all of the users' individual keys to their crypto wallets. There are advantages and disadvantages to using a custodial exchange or wallet. Oft custodial wallets are used out of convenience or habit. Traditional banks are custodial because they control your funds and y'all demand to go through them to get admission to your money. Crypto exchanges and wallets are similar to traditional banks in ready-up and execution. Instead of utilizing the decentralized architecture outlined above, centralized wallets and exchanges are more similar massive databases or accounts. This centralization creates a massive set on surface for hackers or thieves. The dangers of storing account information on a centralized server or database are well-known and hacks that compromise the data of millions of users. There accept been numerous high-profile hacks of crypto exchanges throughout the years.

- Non-custodial crypto exchanges and wallets : A not-custodial crypto wallet means that there is no centralized gatekeeper or account where user avails are stored. Instead, in a non-custodial crypto wallet, user funds are stored on a blockchain and the wallet provides an interface for the user to interact with other users.

- Offline cold storage : Offline cold storage bitcoin wallets tin can come in a few formats, but the thought is to put some kind of gap between your digital avails or cryptocurrencies and an internet connectedness. Most offline cold storage tactics and technologies are designed for long-term and secure storage of bitcoin, crypto, or digital assets. 1 thing to consider when deciding between bitcoin storage options is how frequently y'all programme to need access to your bitcoin or crypto assets and how long you programme on holding those crypto avails.

- Hardware wallets: A bitcoin hardware wallet is a especially designed, encrypted device which connects to a figurer and is capable of storing bitcoin private keys. These devices human action most like specialty USB drives, but they are designed to safely secure bitcoin and provide an added layer of protection between the bitcoin wallet and the user'south internet-connected device. In some senses, a hardware wallet is a kind of like a one-half-step betwixt a spider web-based wallet and a complete off-line cold storage solution. The cracking thing nigh hardware wallets is that they allow users to have some piece of heed considering of the added layer of security, merely the assets stored on the hardware wallets are withal accessible for use and can be sent directly from the wallet to other bitcoin addresses or services.

-

- Paper wallets: A bitcoin newspaper wallet is among the near secure kind of wallets in beingness. To store bitcoin in a paper wallet, users create a public wallet key and a private cardinal and so impress them out on paper. This is one recommended method for long term bitcoin storage. Some people go to actress lengths and impress the wallets on archival paper using loftier-quality ink. It's important that the newspaper wallets are securely stored (yous tin fifty-fifty brand backup copies and store them in different locations). While the upside of a paper wallet is that they make a skilful long-term storage solution, they are non that user-friendly for everyday utilise and they require the added step of making sure the newspaper where the address is stored is adequately secured and protected.

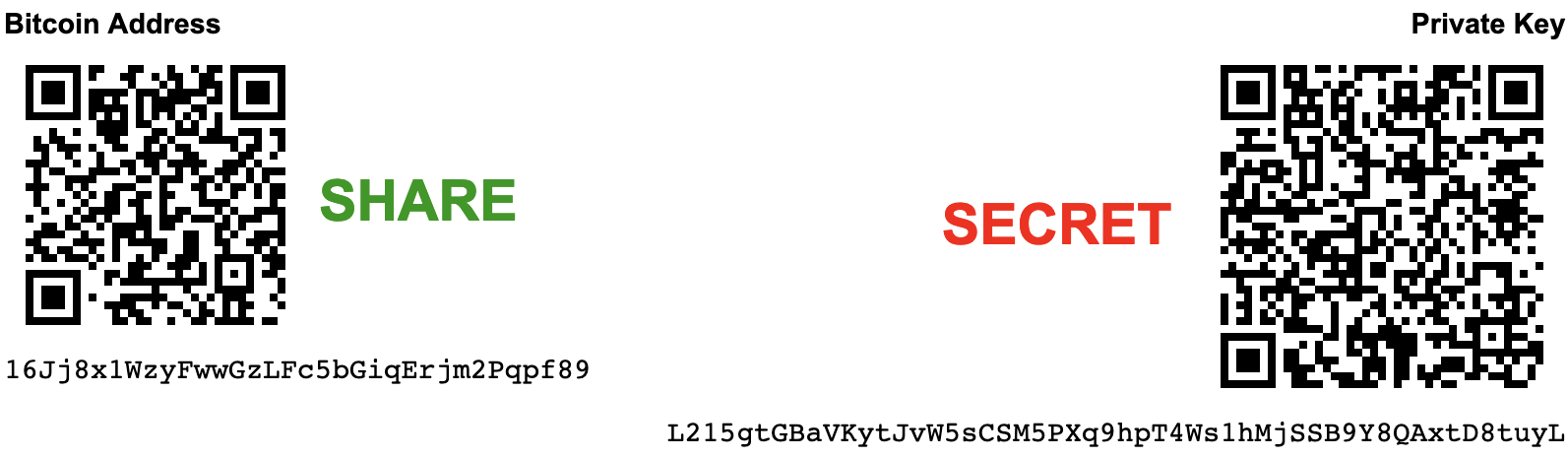

Caption: This is an example of a elementary bitcoin newspaper wallet. These wallet address, which contains a bitcoin public key (or address) and a bitcoin private key were fabricated using the free service bitaddress.org. There are a number of similar services that range from creating elaborate paper wallets to creating simple ones. Image from bitaddress.org

- Hot wallets: A bitcoin hot wallet is a wallet that is constantly connected to the internet. In that location are a couple of reasons for using a hot wallet, but the almost mutual reason is that bitcoin hot wallets are the easiest to access when using bitcoin as a currency or when making frequent trades or transactions. Like cold storage bitcoin wallets, at that place are also a couple of unlike kinds of hot wallets.

- Mobile wallets: Mobile bitcoin wallets are exactly what they sound like. A mobile wallet is based on a mobile device such equally a smartphone or tablet. Most mobile apply the identifying features of the mobile device to help create a unique and secure wallet. Usually, mobile wallets can be restored using a seed phrase if the device containing the wallet is lost or stolen. Obviously, the merchandise-off for always having your bitcoin with you is that yous need to be careful that the mobile wallet is not compromised in other ways. If yous use a mobile bitcoin wallet, implementing adept digital security is important, as is securing the seed phrase that will give you admission to the wallet if y'all need to run a restore.

- Exchange wallets

- Desktop: A bitcoin desktop wallet refers to a crypto wallet where your private keys are stored on the difficult drive of a computer. In some ways, a desktop wallet is like a stride between a mobile wallet and a hardware wallet. While there is an extra physical layer between a potential security threat and your bitcoin, a desktop wallet is not completely secure and tactics like malware or social engineering attacks tin still exist used to proceeds access to any wallet that is connected to the cyberspace.

Bitcoin buying services tin can back up one or more than wallets.

Investing in Bitcoin

1 of the nigh ascendant use cases for bitcoin at the moment is investing ― or speculating that the price will continue to rising over the next several decades as the apply cases outlined above continue to evolve and mature.

Before proceeding, it's really of import to understand that bitcoin, similar any other potential asset is not a sure thing. There are a lot of reasons why the price could go down — including future government regulations, a discovery of a bug or vulnerability (or some other security breach), the emergence of some kind of competitor that is a vast improvement to Bitcoin, the erosion to the incentives (like mining fees) to go along to maintain and upgrade the network in the future, etc.

There are also a lot of reasons that some investors are extremely optimistic or bullish nearly the investment potential of Bitcoin. Either way, information technology'southward actually of import to do your own research around Bitcoin as it is with any potential investment.

How to invest in bitcoin: A new nugget class

One way to think about bitcoin and cryptocurrencies more than broadly is that they are emerging every bit a new asset class. What that means in terms of investing is that bitcoin and other cryptocurrencies can exist useful as a hedge against other investment classes, and besides provide a useful diversification part in traditional investment portfolios.

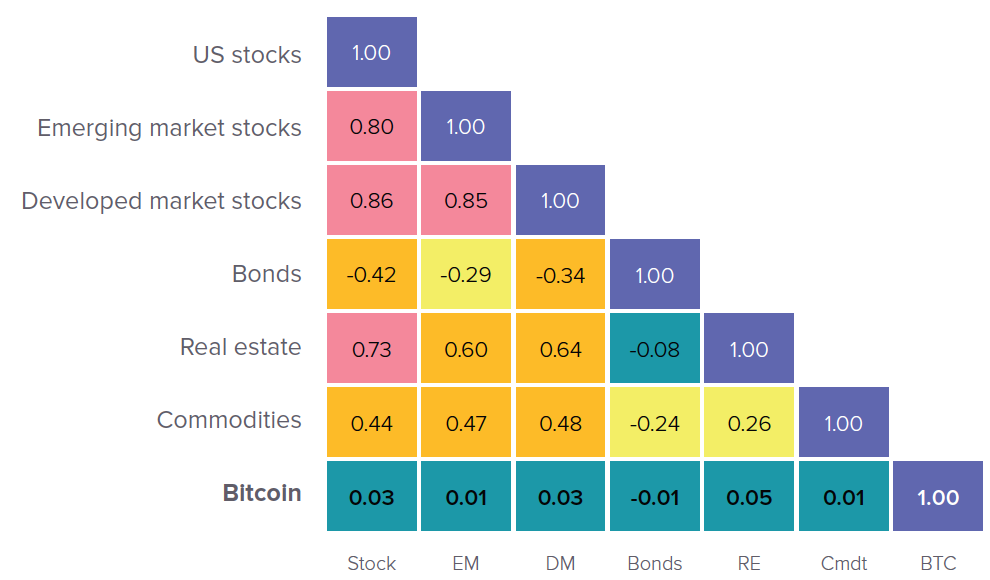

This chart shows Bitcoin'due south relative correlation to other traditional assets. Bitcoin demonstrates a depression correlation, meaning information technology can be a beneficial improver to an investment portfolio. To learn more most Bitcoin in a portfolio context, check out Abra's whitepaper on the topic.

Financial asset classes unremarkably share characteristics among themselves, but they are distinctive from members of other asset classes in the manner they bear. This makes them useful in a portfolio context because if one asset class is losing value, other asset classes might be able to withstand the losses, or if they are completely uncorrelated, some asset classes might increase in value as other avails lose value.

Two master characteristics that are already defining bitcoin and cryptocurrencies as an asset form is that they are uncorrelated to the US stock market and that they take a good Sharpe Ratio or a gamble-adjusted rate of return.

Assay done by Abra has shown that adding even small percentages of bitcoin and cryptocurrencies to a traditional portfolio can help substantially in terms of diversifying hazard exposure and increasing returns over fourth dimension.

When to invest in bitcoin

The question of when to invest in a valuable asset is age-sometime. Bitcoin and other cryptoassets are somewhat notorious for their volatility and bubble-similar nail and bust.

While no one can provide an answer for when to invest in Bitcoin, there are some good benchmarks or waypoints for evaluating Bitcoin's investment potential.

Fourth dimension: As mentioned earlier, Bitcoin has been around for a decade. In that time the network has grown to cover the earth. The number of active nodes and the number of bitcoin wallets in existence has increased, while the value of bitcoin'due south currency has grown from $0 at the beginning of 2009 to several one thousand dollars past 2019. (So far, BTC's all-time was achieved on Dec 16, 2017, when the cost touched $19,665.39).

And so in less than ten years, the price of ane bitcoin has ping-ponged between $0 and nigh $20,000, making a celebrated run that attracted a lot of attention to the nugget's underlying volatility. During the past x years, bitcoin's market run has not been linear. Instead, the growth of bitcoin both from a full general user perspective and from a marketplace perspective has followed a cyclical blueprint of runs and retreats. Ideally, investors secure positions before dramatic market place runs and then make decisions well-nigh profit-taking at the market place peak. This strategy is not only truthful with bitcoin and cryptocurrencies, only with all kinds of investments and asset classes. And so the question near "when is the best fourth dimension to buy bitcoin" is best answered by trying to figure out where the asset is in the timeline of price movement. Of course, if people knew that then investing would be a lot easier.

There are a few things to consider when trying to figure out bitcoin market timing. These are just for consideration and they are not the basis for whatsoever kind of investment decision:

-

- There volition only always exist 21 million bitcoin ever produced. Now, this doesn't exactly tell the whole story, because as you might remember from reading earlier, each bitcoin can be divided by 8 decimal places, just the fact that Bitcoin has a set schedule for creation (the final bitcoin volition be mined in 2140) and that there is no entity that can change to underlying Bitcoin network numbers means that it is a deflationary currency and that equally time goes on it will become more scarce, and likely more valuable.

- From studying previous technological shifts we know that in that location are distinctive ways of tech adoption: Innovators, early adopters, early majority, tardily majority, and then the laggards. This cycle has happened once more and again and is particularly applicative to internet technologies and products. Depending on where y'all think Bitcoin is in the technology adoption cycle should help guide potential investment decisions. While identifying the exact phase of Bitcoin'southward trajectory is difficult, by all accounts, the Bitcoin network and the bitcoin currency are still in the pre-mass adoption phase. Important milestones on the engineering adoption curve include the innovator stage, the early adopter phase, early majority phase, late bulk stage, and so the laggards.

- Network effect: Bitcoin benefits from a network effect. This effect will impact future growth in two ways. The first bear upon of the network effect is that new growth fuels future growth. Just similar the fashion social networks grow — new users invite other users to interact with — new Bitcoin users assist catechumen other users so that they can share value over the network. Since Bitcoin's total addressable market is the whole world, there is really no limit to the potential spread of the network other than bones infrastructure.

- Competition: Bitcoin'south network outcome also works to proceed information technology competitive in the crypto market identify. Equally mentioned earlier, Bitcoin is the oldest cryptocurrency and enjoys a first-mover advantage, but it too has a very active developer community (not to mention its solid design foundation) which means that Bitcoin coins to be number one cryptocurrency by marketplace capitalization. The longer Bitcoin stays in this position, the more information technology reinforces its authorization. Ethereum is the second-place cryptocurrency by market cap, but it has completely different economics.

Cost averaging: Ane simple, just timeless, investing strategy is to average into a market when making investments. The basic concept is to brand small purchases of the investment spread over a long fourth dimension. The goal is to spread the purchases over times when the market is upward and times when the marketplace is down. This is an especially useful tactic when trying to create a position in a volatile market similar bitcoin or cryptocurrencies.

More than money

For all of the reasons outlined above, Bitcoin represents a fundamental shift across a number of fields including finance and informatics. The combination of those two fields will enable confusing technologies, ideas, and companies (including Abra) across a number of fields that touch traditional industries such as banking, coin transfer, investing, and payments. On acme of that, there are also a number of other opportunities that Bitcoin'due south underlying technology enables — and which are merely now being explored and developed.

A full conversation about the ability of Bitcoin would not be complete without mentioning the fact that the evolution of Bitcoin has driven the cosmos and adoption of the unabridged new cryptocurrency and blockchain sector.

Ten years after the publication of the Bitcoin whitepaper , there are more than 2,000 (the number is growing every twenty-four hours). Companies (similar Abra) have sprung up around the world to build on Bitcoin and related technologies. Colleges and universities at present offer degrees in cryptocurrencies and blockchain — and there are fifty-fifty children'south books written virtually the power of decentralization and the next moving ridge of innovation that is made possible because the barriers that Bitcoin breaks down.

Whether you are a veteran crypto investor, or but discovering cryptocurrencies, we always recommend doing your own research and constantly finding ways to acquire more about how crypto works and what some of the latest applications are, which is hard because the field is so innovative and dynamic that new companies, projects, and services are being introduced every twenty-four hour period.

Source: https://www.abra.com/cryptocurrency/bitcoin/